Kredit

| (%i1) | load("FINMAT.mac"); |

1. zadatak

Izračunajte visinu kredita ako ga dužnik mora vratiti kvartalnim otplatama od 3200 kn tijekom 5 godina uz godišnju kamatnu stopu 13.2% i

a) konformno ukamaćivanje,

b) relativno ukamaćivanje.

a) dio

| (%i2) | r:1.132^(1/4); |

| (%i3) | kredit(3200,r,20); |

b) dio

| (%i4) | p:13.2/4; |

| (%i5) | r:1+p/100; |

| (%i6) | kredit(3200,r,20); |

2. zadatak

Kredit od 90 000 kn treba otplatiti u roku od 10 godina polugodišnjim anuitetima i godišnju kamatnu stopu od 6.47%. Nakon točno četiri godine otplate kredita kamatna stopa je povećana za 0.5%. Izračunajte oba anuiteta i sastavite otplatnu tablicu za drugu godinu otplate kredita. Ukamaćivanje je cijelo vrijeme relativno.

| (%i7) | K:90000$ |

prvi anuitet

| (%i8) | p1:6.47/2; |

| (%i9) | r1:1+p1/100; |

| (%i10) | a1:anuitet(K,r1,20); |

ostatak duga nakon 4 godine

| (%i11) | O8:OD(a1,r1,20,8); |

drugi anuitet

| (%i12) | p2:(6.47+0.5)/2; |

| (%i13) | r2:1+p2/100; |

| (%i14) | a2:anuitet(O8,r2,12); |

otplatna tablica

| (%i15) | kredit_tablica(K,r1,20,3,4); |

![(%o15) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[2, "-", "-", "-", 83353.99],<BR>

[3, 6181.61, 2696.5, 3485.11, 79868.88],<BR>

[4, 6181.61, 2583.76, 3597.85, 76271.03]<BR>

)](kredit_htmlimg/kredit_13.png)

cijela otplatna tablica po starim uvjetima

| (%i16) | kredit_tablica(K,r1,20,1,20); |

![(%o16) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[0, "-", "-", "-", 90000],<BR>

[1, 6181.61, 2911.5, 3270.11, 86729.89],<BR>

[2, 6181.61, 2805.71, 3375.9, 83353.99],<BR>

[3, 6181.61, 2696.5, 3485.11, 79868.88],<BR>

[4, 6181.61, 2583.76, 3597.85, 76271.03],<BR>

[5, 6181.61, 2467.37, 3714.24, 72556.79],<BR>

[6, 6181.61, 2347.21, 3834.4, 68722.39],<BR>

[7, 6181.61, 2223.17, 3958.44, 64763.95],<BR>

[8, 6181.61, 2095.11, 4086.5, 60677.45],<BR>

[9, 6181.61, 1962.92, 4218.69, 56458.76],<BR>

[10, 6181.61, 1826.44, 4355.17, 52103.59],<BR>

[11, 6181.61, 1685.55, 4496.06, 47607.53],<BR>

[12, 6181.61, 1540.1, 4641.51, 42966.02],<BR>

[13, 6181.61, 1389.95, 4791.66, 38174.36],<BR>

[14, 6181.61, 1234.94, 4946.67, 33227.69],<BR>

[15, 6181.61, 1074.92, 5106.69, 28121.0],<BR>

[16, 6181.61, 909.71, 5271.9, 22849.1],<BR>

[17, 6181.61, 739.17, 5442.44, 17406.66],<BR>

[18, 6181.61, 563.11, 5618.5, 11788.16],<BR>

[19, 6181.61, 381.35, 5800.26, 5987.9],<BR>

[20, 6181.61, 193.71, 5987.9, 0.0]<BR>

)](kredit_htmlimg/kredit_14.png)

cijela otplatna tablica po novim uvjetima

| (%i17) | kredit_tablica(O8,r2,12,1,12); |

![(%o17) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[0, "-", "-", "-", 60677.46],<BR>

[1, 6273.6, 2114.61, 4158.99, 56518.47],<BR>

[2, 6273.6, 1969.67, 4303.93, 52214.54],<BR>

[3, 6273.6, 1819.68, 4453.92, 47760.62],<BR>

[4, 6273.6, 1664.46, 4609.14, 43151.48],<BR>

[5, 6273.6, 1503.83, 4769.77, 38381.71],<BR>

[6, 6273.6, 1337.6, 4936.0, 33445.71],<BR>

[7, 6273.6, 1165.58, 5108.02, 28337.69],<BR>

[8, 6273.6, 987.57, 5286.03, 23051.66],<BR>

[9, 6273.6, 803.35, 5470.25, 17581.41],<BR>

[10, 6273.6, 612.71, 5660.89, 11920.52],<BR>

[11, 6273.6, 415.43, 5858.17, 6062.35],<BR>

[12, 6273.6, 211.25, 6062.35, 0.0]<BR>

)](kredit_htmlimg/kredit_15.png)

3. zadatak

Kredit visine 85 000 kn odobren je na pet godina uz otplatu mjesečnim anuitetima. Nakon dvije godine podigne se dopunski kredit od 25 000 kn koji se otplaćuje zajedno s preostalim dijelom starog kredita u dogovoreno vrijeme. Izračunajte oba anuiteta i izradite otplatnu tablicu za prva tri mjeseca četvrte godine otplate kredita. Godišnja kamatna stopa iznosi 7.2%, a ukamaćivanje je cijelo vrijeme relativno.

| (%i18) | K:85000$ |

| (%i19) | p:7.2/12; |

| (%i20) | r:1+p/100; |

prvi anuitet

| (%i21) | a1:anuitet(K,r,60); |

ostatak duga nakon dvije godine

| (%i22) | O24:OD(a1,r,60,24); |

novi ostatak duga

| (%i23) | Kc:O24+25000; |

drugi anuitet

| (%i24) | a2:anuitet(Kc,r,60−24); |

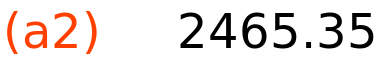

otplatna tablica

| (%i25) | kredit_tablica(Kc,r,36,13,15); |

![(%o25) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[12, "-", "-", "-", 54952.49],<BR>

[13, 2465.35, 329.71, 2135.64, 52816.85],<BR>

[14, 2465.35, 316.9, 2148.45, 50668.4],<BR>

[15, 2465.35, 304.01, 2161.34, 48507.06]<BR>

)](kredit_htmlimg/kredit_22.png)

cijela otplatna tablica po starim uvjetima

| (%i26) | kredit_tablica(K,r,60,1,60); |

![(%o26) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[0, "-", "-", "-", 85000],<BR>

[1, 1691.13, 510.0, 1181.13, 83818.87],<BR>

[2, 1691.13, 502.91, 1188.22, 82630.65],<BR>

[3, 1691.13, 495.78, 1195.35, 81435.3],<BR>

[4, 1691.13, 488.61, 1202.52, 80232.78],<BR>

[5, 1691.13, 481.4, 1209.73, 79023.05],<BR>

[6, 1691.13, 474.14, 1216.99, 77806.06],<BR>

[7, 1691.13, 466.84, 1224.29, 76581.77],<BR>

[8, 1691.13, 459.49, 1231.64, 75350.13],<BR>

[9, 1691.13, 452.1, 1239.03, 74111.1],<BR>

[10, 1691.13, 444.67, 1246.46, 72864.64],<BR>

[11, 1691.13, 437.19, 1253.94, 71610.7],<BR>

[12, 1691.13, 429.66, 1261.47, 70349.23],<BR>

[13, 1691.13, 422.1, 1269.03, 69080.2],<BR>

[14, 1691.13, 414.48, 1276.65, 67803.55],<BR>

[15, 1691.13, 406.82, 1284.31, 66519.24],<BR>

[16, 1691.13, 399.12, 1292.01, 65227.23],<BR>

[17, 1691.13, 391.36, 1299.77, 63927.46],<BR>

[18, 1691.13, 383.56, 1307.57, 62619.89],<BR>

[19, 1691.13, 375.72, 1315.41, 61304.48],<BR>

[20, 1691.13, 367.83, 1323.3, 59981.18],<BR>

[21, 1691.13, 359.89, 1331.24, 58649.94],<BR>

[22, 1691.13, 351.9, 1339.23, 57310.71],<BR>

[23, 1691.13, 343.86, 1347.27, 55963.44],<BR>

[24, 1691.13, 335.78, 1355.35, 54608.09],<BR>

[25, 1691.13, 327.65, 1363.48, 53244.61],<BR>

[26, 1691.13, 319.47, 1371.66, 51872.95],<BR>

[27, 1691.13, 311.24, 1379.89, 50493.06],<BR>

[28, 1691.13, 302.96, 1388.17, 49104.89],<BR>

[29, 1691.13, 294.63, 1396.5, 47708.39],<BR>

[30, 1691.13, 286.25, 1404.88, 46303.51],<BR>

[31, 1691.13, 277.82, 1413.31, 44890.2],<BR>

[32, 1691.13, 269.34, 1421.79, 43468.41],<BR>

[33, 1691.13, 260.81, 1430.32, 42038.09],<BR>

[34, 1691.13, 252.23, 1438.9, 40599.19],<BR>

[35, 1691.13, 243.6, 1447.53, 39151.66],<BR>

[36, 1691.13, 234.91, 1456.22, 37695.44],<BR>

[37, 1691.13, 226.17, 1464.96, 36230.48],<BR>

[38, 1691.13, 217.38, 1473.75, 34756.73],<BR>

[39, 1691.13, 208.54, 1482.59, 33274.14],<BR>

[40, 1691.13, 199.64, 1491.49, 31782.65],<BR>

[41, 1691.13, 190.7, 1500.43, 30282.22],<BR>

[42, 1691.13, 181.69, 1509.44, 28772.78],<BR>

[43, 1691.13, 172.64, 1518.49, 27254.29],<BR>

[44, 1691.13, 163.53, 1527.6, 25726.69],<BR>

[45, 1691.13, 154.36, 1536.77, 24189.92],<BR>

[46, 1691.13, 145.14, 1545.99, 22643.93],<BR>

[47, 1691.13, 135.86, 1555.27, 21088.66],<BR>

[48, 1691.13, 126.53, 1564.6, 19524.06],<BR>

[49, 1691.13, 117.14, 1573.99, 17950.07],<BR>

[50, 1691.13, 107.7, 1583.43, 16366.64],<BR>

[51, 1691.13, 98.2, 1592.93, 14773.71],<BR>

[52, 1691.13, 88.64, 1602.49, 13171.22],<BR>

[53, 1691.13, 79.03, 1612.1, 11559.12],<BR>

[54, 1691.13, 69.35, 1621.78, 9937.34],<BR>

[55, 1691.13, 59.62, 1631.51, 8305.83],<BR>

[56, 1691.13, 49.83, 1641.3, 6664.53],<BR>

[57, 1691.13, 39.99, 1651.14, 5013.39],<BR>

[58, 1691.13, 30.08, 1661.05, 3352.34],<BR>

[59, 1691.13, 20.11, 1671.02, 1681.32],<BR>

[60, 1691.13, 9.81, 1681.32, 0.0]<BR>

)](kredit_htmlimg/kredit_23.png)

cijela otplatna tablica po novim uvjetima

| (%i27) | kredit_tablica(Kc,r,36,1,36); |

![(%o27) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[0, "-", "-", "-", 79607.85],<BR>

[1, 2465.35, 477.65, 1987.7, 77620.15],<BR>

[2, 2465.35, 465.72, 1999.63, 75620.52],<BR>

[3, 2465.35, 453.72, 2011.63, 73608.89],<BR>

[4, 2465.35, 441.65, 2023.7, 71585.19],<BR>

[5, 2465.35, 429.51, 2035.84, 69549.35],<BR>

[6, 2465.35, 417.3, 2048.05, 67501.3],<BR>

[7, 2465.35, 405.01, 2060.34, 65440.96],<BR>

[8, 2465.35, 392.65, 2072.7, 63368.26],<BR>

[9, 2465.35, 380.21, 2085.14, 61283.12],<BR>

[10, 2465.35, 367.7, 2097.65, 59185.47],<BR>

[11, 2465.35, 355.11, 2110.24, 57075.23],<BR>

[12, 2465.35, 342.45, 2122.9, 54952.33],<BR>

[13, 2465.35, 329.71, 2135.64, 52816.69],<BR>

[14, 2465.35, 316.9, 2148.45, 50668.24],<BR>

[15, 2465.35, 304.01, 2161.34, 48506.9],<BR>

[16, 2465.35, 291.04, 2174.31, 46332.59],<BR>

[17, 2465.35, 278.0, 2187.35, 44145.24],<BR>

[18, 2465.35, 264.87, 2200.48, 41944.76],<BR>

[19, 2465.35, 251.67, 2213.68, 39731.08],<BR>

[20, 2465.35, 238.39, 2226.96, 37504.12],<BR>

[21, 2465.35, 225.02, 2240.33, 35263.79],<BR>

[22, 2465.35, 211.58, 2253.77, 33010.02],<BR>

[23, 2465.35, 198.06, 2267.29, 30742.73],<BR>

[24, 2465.35, 184.46, 2280.89, 28461.84],<BR>

[25, 2465.35, 170.77, 2294.58, 26167.26],<BR>

[26, 2465.35, 157.0, 2308.35, 23858.91],<BR>

[27, 2465.35, 143.15, 2322.2, 21536.71],<BR>

[28, 2465.35, 129.22, 2336.13, 19200.58],<BR>

[29, 2465.35, 115.2, 2350.15, 16850.43],<BR>

[30, 2465.35, 101.1, 2364.25, 14486.18],<BR>

[31, 2465.35, 86.92, 2378.43, 12107.75],<BR>

[32, 2465.35, 72.65, 2392.7, 9715.05],<BR>

[33, 2465.35, 58.29, 2407.06, 7307.99],<BR>

[34, 2465.35, 43.85, 2421.5, 4886.49],<BR>

[35, 2465.35, 29.32, 2436.03, 2450.46],<BR>

[36, 2465.35, 14.89, 2450.46, 0.0]<BR>

)](kredit_htmlimg/kredit_24.png)

Vidimo da se u dijelu tablice od k=12 do k=15 ostatak duga razlikuje u desetak lipa od ostatka duga kada smo taj dio podtablice dobili direktno u rješavanju zadatka. To se može dogoditi zbog grešaka zaokruživanja i konačne aritmetike na računalu.

Ako krenemo od k=1, tada uopće ne koristimo formulu za računaje ostatka duga O_k, nego stalno primijenjujemo iterativnu formulu O_k=O_{k-1}-R_k.

Ako napravimo tablicu od k=2 do k=36, tada se promatrani ostatak duga razlikuje samo u jednoj ili dvije lipe u dijelu od k=12 do k=15.

| (%i28) | kredit_tablica(Kc,r,36,2,36); |

![(%o28) matrix(<BR>

["k", "a", "Ik", "Rk", "Ok"],<BR>

[1, "-", "-", "-", 77620.3],<BR>

[2, 2465.35, 465.72, 1999.63, 75620.67],<BR>

[3, 2465.35, 453.72, 2011.63, 73609.04],<BR>

[4, 2465.35, 441.65, 2023.7, 71585.34],<BR>

[5, 2465.35, 429.51, 2035.84, 69549.5],<BR>

[6, 2465.35, 417.3, 2048.05, 67501.45],<BR>

[7, 2465.35, 405.01, 2060.34, 65441.11],<BR>

[8, 2465.35, 392.65, 2072.7, 63368.41],<BR>

[9, 2465.35, 380.21, 2085.14, 61283.27],<BR>

[10, 2465.35, 367.7, 2097.65, 59185.62],<BR>

[11, 2465.35, 355.11, 2110.24, 57075.38],<BR>

[12, 2465.35, 342.45, 2122.9, 54952.48],<BR>

[13, 2465.35, 329.71, 2135.64, 52816.84],<BR>

[14, 2465.35, 316.9, 2148.45, 50668.39],<BR>

[15, 2465.35, 304.01, 2161.34, 48507.05],<BR>

[16, 2465.35, 291.04, 2174.31, 46332.74],<BR>

[17, 2465.35, 278.0, 2187.35, 44145.39],<BR>

[18, 2465.35, 264.87, 2200.48, 41944.91],<BR>

[19, 2465.35, 251.67, 2213.68, 39731.23],<BR>

[20, 2465.35, 238.39, 2226.96, 37504.27],<BR>

[21, 2465.35, 225.03, 2240.32, 35263.95],<BR>

[22, 2465.35, 211.58, 2253.77, 33010.18],<BR>

[23, 2465.35, 198.06, 2267.29, 30742.89],<BR>

[24, 2465.35, 184.46, 2280.89, 28462.0],<BR>

[25, 2465.35, 170.77, 2294.58, 26167.42],<BR>

[26, 2465.35, 157.0, 2308.35, 23859.07],<BR>

[27, 2465.35, 143.15, 2322.2, 21536.87],<BR>

[28, 2465.35, 129.22, 2336.13, 19200.74],<BR>

[29, 2465.35, 115.2, 2350.15, 16850.59],<BR>

[30, 2465.35, 101.1, 2364.25, 14486.34],<BR>

[31, 2465.35, 86.92, 2378.43, 12107.91],<BR>

[32, 2465.35, 72.65, 2392.7, 9715.21],<BR>

[33, 2465.35, 58.29, 2407.06, 7308.15],<BR>

[34, 2465.35, 43.85, 2421.5, 4886.65],<BR>

[35, 2465.35, 29.32, 2436.03, 2450.62],<BR>

[36, 2465.35, 14.73, 2450.62, 0.0]<BR>

)](kredit_htmlimg/kredit_25.png)

4. zadatak

Dogovoreno je da se kredit visine 190 000 kn otplati tijekom 7 godina jednakim kvartalnim anuitetima i relativno ukamaćivanje uz godišnju kamatnu stopu 10.9% i poček od godinu dana. Nakon 20 otplata prijeđeno je na otplatu mjesečnim anuitetima, a kamatna stopa je smanjena na 10.5%. Odredite interkalarne kamate, prvi i drugi anuitet, ukupno plaćene kamate i uštedu na kamatama uslijed smanjenja kamatne stope.

| (%i29) | K:190000$ |

prvi anuitet

| (%i30) | p1:10.9/4; |

| (%i31) | r1:1+p1/100; |

| (%i32) | a1:anuitet(K,r1,28); |

ostatak duga nakon 20 kvartalnih otplata

| (%i33) | O20:OD(a1,r1,28,20); |

drugi anuitet

| (%i34) | p2:10.5/12; |

| (%i35) | r2:1+p2/100; |

| (%i36) | a2:anuitet(O20,r2,24); |

interkalarne kamate za jedno razdoblje (kvartal)

| (%i37) | inter:K·p1/100; |

ukupne interkalarne kamate (jedna godina)

| (%i38) | 4·inter; |

ukupno plaćene kamate

| (%i39) | dec(20·a1+24·a2−K,2); |

ušteda na kamatama uslijed smanjenja kamatne stope

| (%i40) | dec(8·a1−24·a2,2); |